Description

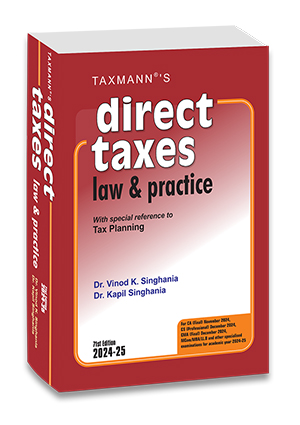

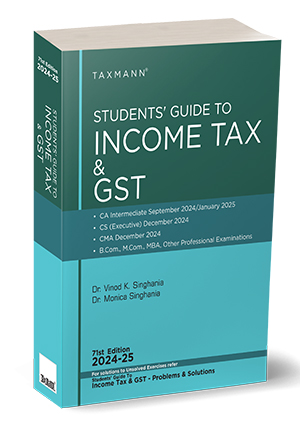

For over 40 years, Taxmann’s flagship publication on Direct Taxes has been the ‘go-to-guide’ for students and professional practitioners. This book is designed to help readers understand the law and develop the ability to apply it effectively. It aims to provide the following:

- [Familiarity with Direct Tax Provisions] Understand the fundamental aspects of direct tax laws

- [Awareness of Direct Tax Provisions] Understand the specific provisions and their implications

- [Understanding the Nature and Scope] Comprehend the breadth and application of direct tax laws

- [Up-to-date Knowledge] Stay updated about how various courts have interpreted statutory provisions over time

Written in clear and simple language, this book explains the provisions of the law in a step-by-step and concise manner, using suitable illustrations and avoiding legal jargon and paraphrasing sections.

This book will be helpful for students preparing for CA, CS, ICWA, M.Com., LL.B. and MBA examinations, as well as for those appearing in the income-tax departmental examination.

The Present Publication is the 71st Edition for A.Y. 2024-25 (amended up to 15th June 2024), authored by Dr Vinod K. Singhania & Dr Kapil Singhania. The noteworthy features of this book are as follows:

- [Self-Learning/Practice Book] Designed with a learn-yourself technique, enabling students to grasp and apply the law more quickly

- [Concise Treatment of Text] The content is organized in numbered paragraphs and sub-paragraphs, saving time and effort. Debatable issues are thoroughly discussed and resolved

- [Well-Thought-Out Original Problems] Each paragraph begins with analytical discussions supported by over 600 original problems, illustrating complex provisions in a unique style. Tax planning hints are provided where applicable

- [Up-to-date Content] Includes the latest circulars, notifications, amendments, and case laws up to 15th June 2024. Recent court rulings, circulars, and notifications are highlighted

- [Past Exam Questions with Answers] Contains questions from CA Final exams (Nov. 2013 to Nov. 2023), post-graduate, and professional exams, along with solutions for both theory and practical questions, based on the law applicable for A.Y. 2024-25.

- [Six-Sigma Approach] Adheres to the Six-Sigma methodology to achieve the benchmark of ‘Zero-Error’

The detailed coverage of this book includes:

- Basic Concepts

- Residential Status and Tax Incidence

- Incomes Exempt from Tax

- Salaries

- Income from House Property

- Profits and Gains of Business or Profession

- Capital Gains

- Income from Other Sources

- Income of Other Persons included in Assessee’s Total Income

- Set Off and Carry Forward of Losses

- Deductions from Gross Total Income and Tax Liability

- Agricultural Income

- Typical Problems on the Assessment of Individuals

- Tax Treatment of Hindu Undivided Families

- Special Provisions Governing Assessment of Firms and Associations of Persons

- Taxation of Companies

- Assessment of Co-operative Societies

- Assessment of Charitable and Other Trusts

- Returns of Income and Assessment

- Penalties and Prosecution

- Advance Payment of Tax

- Interest

- Tax Deduction or Collection at Source

- Refund of Excess Payments

- Appeals and Revisions

- Income-tax Authorities

- Settlement Commission and Dispute Resolution Committee

- Special Measures in Respect of Transactions with Persons Located in Notified Jurisdiction Area

- General Anti-avoidance Rule

- Advance Ruling

- Search, Seizure and Assessment

- Transfer Pricing

- Business Restructuring

- Alternative Tax Regime

- Tax Planning

- Miscellaneous

- Annexures

- Tax Rates

- Rates of Depreciation

- The Eleventh Schedule, Thirteenth Schedule, Fourteenth Schedule/Investment ceiling in the case of small-scale industrial undertaking

- Notified backward districts

- Question set for CA (Final) Examination and Answers from Nov. 2013 to Nov. 2023

Vinod K. Singhania

Dr. Vinod K. Singhania got his PhD from the Delhi School of Economics in 1976. His field of special interest includes all facets of corporate legislation and corporate economics, especially tax laws.

Associated in different capacities with several professional institutes and business houses in India and abroad, Dr. Singhania has authored many popular books and software published by Taxmann.

He has to his credit more than 300 research articles that have appeared in leading journals. He has been a resource person in over 800 seminars in India and abroad.

Kapil Singhania

Dr Kapil Singhania, a Fellow of the Institute of Chartered Accountants of India and belonging to the alumni of Shri Ram College of Commerce, has completed his research work, for which he was awarded a PhD in 2003. His fields of involvement in research work in the form of articles in various reputed journals and analytical studies span from corporate laws to direct and indirect taxation.

He has authored various acclaimed books on direct and indirect taxes published by Taxmann. Dr Singhania is providing tax consultancy to several business organizations, which include multinational and public sector companies.

Reviews

There are no reviews yet.