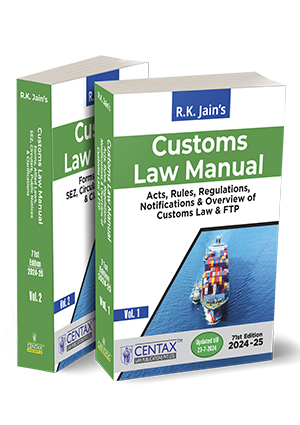

This detailed compendium provides a thorough understanding of Customs Law and Procedures in India, divided into two volumes. Edited by R.K. Jain, it covers various aspects of customs regulations, acts, rules, and allied topics. The book is organized into nine parts, including the Customs Act, rules, notifications, forms, SEZs, etc.

Description

This book is a detailed compendium designed to provide a thorough understanding of Customs Law and Procedures in India. It is divided into two volumes, covering various aspects of customs regulations, acts, rules, and allied topics.

This book is helpful for legal practitioners, customs brokers and agents, professionals engaged in international trade, government officials, and consultants.

The Present Publication is the 71st Edition | 2024-25 and has been updated till 23rd July 2024. This book is edited by R.K. Jain and has been divided into nine parts:

- Part 1 – Customs Act, 1962

- Part 2 – Customs Rules and Regulations

- Part 3 – Appeal, Revision and Appellate Tribunal’s Rules, Notifications and Orders

- Part 4 – Notifications issued under the Customs Act, 1962

- Part 5 – Customs Forms & Bonds

- Part 6 – Allied Acts, Rules and Regulations

- Part 7 – CBIC’s Customs Manual of Instructions with Latest Instructions/Circulars

- Part 8 – Special Economic Zones

- Part 9 – Chronological List of Notifications issued under the Customs Act, 1962 by the Finance Ministry and Customs Commissionerate

R.K. Jain

Sh. R.K. Jain is a distinguished author specializing in Indirect Taxes, including Customs, Central Excise, Service Tax, Foreign Trade Policy (FTP), GST, and FEMA. He began his illustrious career in the early seventies. In 1975, he published the seminal works ‘Customs & Excise Tariffs and Manuals,’ which have recently celebrated their Silver and Golden Jubilee Editions.

Sh. R.K. Jain is also the editor of ‘Excise Law Times (E.L.T.),’ launched nearly 45 years ago. This journal brought significant awareness to Central Excise and Customs and has grown to become the leading publication in its field with the largest circulation.

In addition to E.L.T., he started ‘Service Tax Review’ in 2006 and ‘R.K. Jain’s GST Law Times’ in 2017, following the major Indirect Tax Reform introduced by GST. ExCus, the digital version of these journals, continues to provide valuable insights and updates on Indirect Taxes.

Reviews

There are no reviews yet.