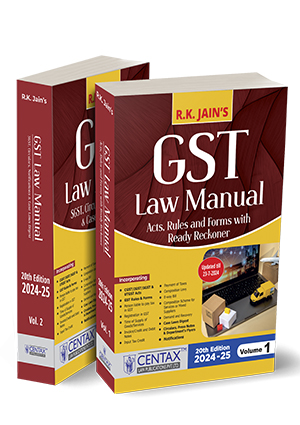

This book is a comprehensive compendium that provides complete, updated, amended, and annotated texts of all provisions of the GST Law. It is organized into eleven parts covering GST Acts, Rules, Reverse Charge Mechanism, Forms, State GST, Circulars, Case Laws, Notifications, Appeals, etc.

Description

This book is a comprehensive compendium that provides complete, updated, amended, and annotated texts of all provisions of the GST Law. It is organized into eleven parts:

- Part 1 – GST Ready Reckoner

- Part 2 – GST Acts

- Part 3 – GST Rules

- Part 4 – Reverse Charge Mechanism

- Part 5 – Forms & Proformas

- Part 6 – State GST & Compensation Cess

- Part 7 – Circulars, Press Releases & Public Notices

- Part 8 – Case Laws Digest

- Part 9 – Notifications

- Part 10 – Appeals & Revisions

- Part 11 – Index to Notifications

This book is helpful for tax practitioners, consultants, chartered accountants, auditors, business owners, managers, government officials, and policymakers, providing them with up-to-date information on GST.

The Present Publication is the 20th Edition | 2024-25, updated until 23rd July 2024. It is authored by R.K. Jain and edited by CA. (Dr) Arpit Halida. The coverage of this book is as follows:

- GST Ready Reckoner

- GST Acts

- CGST Act, 2017

- CGST (Extension to Jammu and Kashmir) Act, 2017

- IGST Act, 2017

- IGST (Extension to Jammu and Kashmir) Act, 2017

- UTGST Act, 2017

- GST (Compensation to States) Act, 2017

- Constitution (One Hundred and First Amendment) Act, 2016

- Validating Provisions relating to Goods and Services Tax

- GST Rules

- Reverse Charge Mechanism for Goods & Services

- GST Forms & Proformas

- State GST & Compensation Cess

- Circulars, Press Releases & Public Notices

- Departmental Clarification, Flyers/Leaflets, Circulars, Public Notices & Press Releases on GST

- Case Laws Digest

- Notifications

- Notifications issued under CGST/IGST/UTGST/SGST (including those issued by States)

- Appeals & Revisions

- GST Appellate Tribunal – Notifications & Order

- Index to Notifications

R.K. Jain

Sh. R.K. Jain is a distinguished author specializing in Indirect Taxes, including Customs, Central Excise, Service Tax, Foreign Trade Policy (FTP), GST, and FEMA. He began his illustrious career in the early seventies. In 1975, he published the seminal works ‘Customs & Excise Tariffs and Manuals,’ which have recently celebrated their Silver and Golden Jubilee Editions.

Sh. R.K. Jain is also the editor of ‘Excise Law Times (E.L.T.),’ launched nearly 45 years ago. This journal brought significant awareness to Central Excise and Customs and has grown to become the leading publication in its field with the largest circulation.

In addition to E.L.T., he started ‘Service Tax Review’ in 2006 and ‘R.K. Jain’s GST Law Times’ in 2017, following the major Indirect Tax Reform introduced by GST. ExCus, the digital version of these journals, continues to provide valuable insights and updates on Indirect Taxes.

![Taxmann's - Bharatiya Nyaya Sanhita 2023 | Flexi-bound [Pocket] Edition](https://cashapers.in/wp-content/uploads/2024/08/Book1.1.jpg)

Reviews

There are no reviews yet.