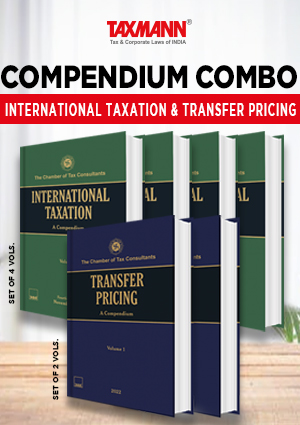

These books, authored by 350+ recognised domain experts, are a COMBO for International Taxation – A Compendium & Transfer Pricing – A Compendium. Both the Compendiums are a collection of incisive & in-depth articles on international taxation & transfer pricing. The Compendiums will equip its readers with better knowledge and practical examples to serve their clients better.

Description

These books, authored by 350+ recognised domain experts, are a COMBO for the following books:

- International Taxation – A Compendium | 4th Edition

- Transfer Pricing – A Compendium | 2022 Edition

The key features of these books are as follows:

International Taxation – A Compendium

This Compendium is a collection of incisive & in-depth articles on international taxation, which serves as a reference manual and, indeed, a practice guide for its readers. The current Edition of the Compendium is more current, more incisive, covers a broader range of topics, and like its previous three editions, promises to be another handy tool for the following:

- Tax Professionals both in India and Overseas

- Judiciary and Tax administrators ought to find this a useful reference point both for technical analysis and for understanding the right perspective to view some of the international tax developments of the recent past.

This Compendium will equip its readers with better knowledge and practical examples to serve their clients better. The current Edition of the Compendium is a comprehensive four-volume set containing approximately 5,200+ pages covering all major topics on the subject of International Taxation, such as:

- Amendments made in the Income-tax Act, 1961

- Changes introduced in the OECD Model Tax Convention, 2017

- Updates introduced in the OECD Model Commentary in 2017

- Updates introduced in UN Model Tax Convention in 2017

- Global Focus on combating Tax Evasion

- Initiation of various Anti Avoidance Measures and tightening of Anti Money Laundering Laws

- Implementation of Multilateral Instruments pursuant to the BEPS Action Plan Reports in October 2015.

The Present Publications is the 4th Edition, covering 137 Articles authored by 200+ Experts. This Compendium is a balanced collection of articles by recognised experts in the field, by young and eminent professionals, and by experienced and knowledgeable Commissioners of Income-tax & Senior Ex- Revenue Officials. This book is divided into four volumes, and their contents (volume-wise) are listed below:

- Volume 1 & 2 contains articles explaining the following:

- Theme/basic concepts of Double Tax Avoidance Agreements

- Various Articles of Model Tax Convention

- Specific provisions of the Domestic Law dealing with the Taxation of Non-Residents and Cross-Border Transactions

- Volume 3 contains industry-specific articles such as:

- Taxation of Telecom Sector

- Broadcasting & Telecasting industries

- Electronic Commerce

- Foreign Banks, Offshore Funds, FII’s etc.

- Volume 4 contains articles on the following:

- FEMA and other Domestic Laws such as the Prevention of Money Laundering Act, Foreign Contribution Regulation Act, Black Money Act, Benami Law

- Various Anti-Avoidance Measures & other specialised articles

Transfer Pricing – A Compendium

This Compendium is a collection of incisive & in-depth articles on transfer pricing, authored by recognised experts. This Compendium promises to provide the necessary guidance and support to fellow professionals to understand the intricate issues, which have always remained contentious and challenging.

The current Edition of the Compendium is updated, incisive, and covers a broader range of topics. Like its previous Edition, this Compendium promises to be another handy tool for the following:

- Tax Professionals both in India and Overseas

- Judiciary and Tax administrators

- Readers who want a useful reference point, both for technical analysis and for understanding the proper perspective to view some of the transfer pricing developments of the recent past

The Present Publication is the 2022 Edition, covering 75 articles by 150 authors in a comprehensive set of 2 volumes, with the following noteworthy features:

- [Covering All Aspects of Transfer Pricing] such as:

- Technical Corner, including the advanced issues

- Legal Corner

- Advanced Pricing Agreement (APA) & Mutual Agreement Procedure (MAP)Corner

- Industry Corner includes 25 sectors

- Global Corner including country-wise transfer pricing regulations, the impact of COVID on APA & Dispute resolution, OECD Pillar One & Two

- [Understand & Manage Transfer Pricing Risks] This book helps the readers/taxpayers in understanding the complex subject and consequently help them manage their transfer pricing risk effectively

- [Authored by 150 Transfer Pricing Experts] The wisdom of eminent authors & their rich experience will be handy for the readers to deal with the complex subject efficiently with a greater degree of confidence

- [Practical Examples] The authors, with their immense experience, have extensively covered the subject in greater detail with practical examples

Reviewed by Shri S.E. Dastur | Senior Advocate

- “… The present publication is in pursuance of the Chamber’s Vision Statement “to contribute to the development of law … through research, analysis and dissemination of knowledge….”

- “… Reference is made, very perceptively and appropriately, to the OECD and UN guidelines on the subject and prevailing international practices, not to mention the latest case laws….”

- “… What makes it unique is that it has articles on every conceivable transfer pricing issue authored by over 130 learned professionals (lawyers and chartered accountants) and even some top Revenue officers….”

- “… The fact that most of the articles are authored by more than one person ensures that the reader benefits from their collective wisdom on each relevantly chosen subject….”

The Chamber of Tax Consultants

The Chamber of Tax Consultants (The Chamber) was established in 1926 and is one of the oldest voluntary non-profit professional organisations. It is the voice of more than 4,000 professionals on a pan-India basis. Its members comprise Advocates, Chartered Accountants, Company Secretaries, Cost Accountants, Corporates, Tax Consultants and Students.

The Chamber, despite its vintage, is a young, dynamic organisation having a glorious past and an undisputedly ambitious future. The Chamber is a well-respected institution with high integrity, independence and professional tradition.

The Chamber acts as a powerhouse of knowledge in fiscal law, always proactive in contributing to the development of law and profession through research and analysis, dissemination of knowledge and proactive interaction with policymakers. The Chamber also provides professionals with several networking opportunities through interactive meetings and seminars.

Professional luminaries like Late Shri B. C. Joshi, Late Shri V. H. Patil, Dr Y. P. Trivedi, Shri S. E. Dastur, Late Shri D. M. Harish, Late Shri Narayan Varma, Dr K. Shivaram, Shri S. N. Inamdar, have been The Chamber’s Presidents.

For The Chamber, education is the supreme power, and the spread of education is its motto.

The Chamber strives to be pre-eminent in upholding a tradition of excellence in service and principled conduct with social responsibility among professionals. The various initiatives of The Chamber are listed below:

- Knowledge sharing initiatives

- The Chamber’s Journals and CTC Newsletter

- International Tax Journal

- Representation before Regulatory Authorities and Public Interest Litigations

- The Chamber’s Library and Website

- Initiative for Student Members

Reviews

There are no reviews yet.