Direct Tax

No of Lectures – 60 -65 Lectures

Duration – 155 – 160 hours

Validity – 9 Months from the date of activation

Views – 1.5 Times

Study Material – 1 Compact Theory Book 1 Compact Q&A Book

Indirect Tax (GST)

No. of Lectures – 40 approx

Duration – 120 hours approx

Validity – 12 Months From the Date of Activation

View – 1.5 Views

Study Material – Main module / Question answers and MCQ’s

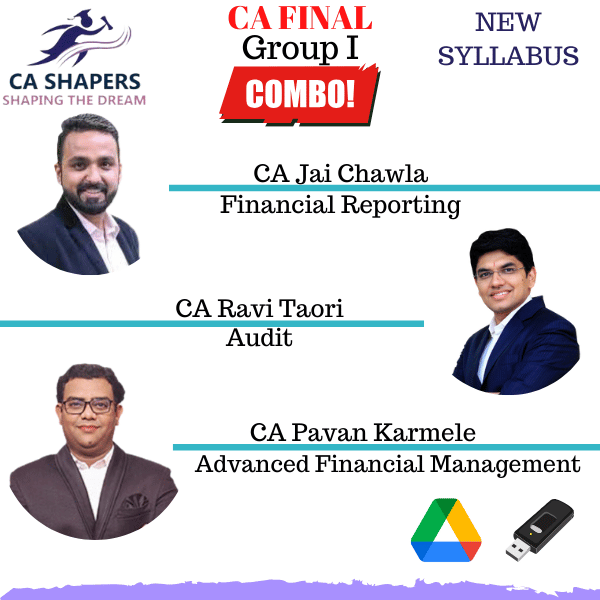

CA Final – Financial Reporting FR – CA Jai Chawla : Regular In-Depth Course

₹8,899.00 – ₹10,899.00

| Course Highlights |

| 1. Regular In-Depth Batch - Live+Recorded Batch started from 18th Jan 2025 2. 100% syllabus coverage as per ICAI Study Module 3. Applicable for Jan/May/Sep 2026 & 2027 Attempts 4. Two-Time Views with Unlimited Validity 5. Practice of Maximum Questions in Class 6. New Simplified Concept Book (350 Pages) 7. Class Test with checking facility. 8. Every 15 Days Zoom Guidance |

CA FINAL ICAI NEW SCHEME – AUDIT REGULAR IN DEPTH BY CA RAVI TAORI

₹6,999.00 – ₹7,999.00

Reviews

There are no reviews yet.