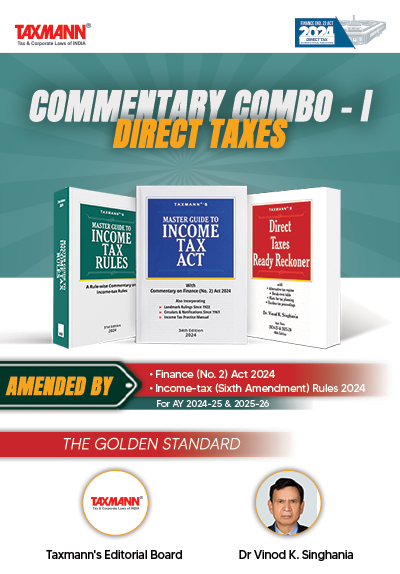

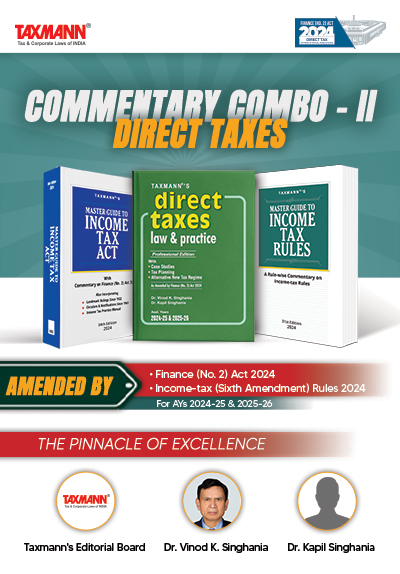

This Combo is the gold standard in direct taxation, providing unparalleled depth, precision, and authority. Curated by Taxmann’s Editorial Board and Dr Vinod K. Singhania, this set includes three essential volumes—Master Guide to Income Tax Act (34th Edition), Master Guide to Income Tax Rules (31st Edition), and Direct Taxes Ready Reckoner (48th Edition). Together, these books provide comprehensive analysis, practical tools, and up-to-date commentary.

Description

The Commentary Combo – I for Direct Taxes is the gold standard in direct taxes, providing a level of depth, precision, and authority that is virtually unmatched. It combines three publications that are helpful for tax professionals, legal practitioners, and tax officers. This curated set, authored/edited by Taxmann’s Editorial Board and Dr Vinod K. Singhania, features the latest editions of the following:

- Master Guide to Income Tax Act | 34th Edition

- Master Guide to Income Tax Rules | 31st Edition

- Direct Taxes Ready Reckoner | 48th Edition | AYs 2024 & 25 & 2025-26

The key features of these books are as follows:

Master Guide to Income Tax Act | 34th Edition

Master Guide to Income Tax Act is an authoritative resource, setting a benchmark in the field with its comprehensive and precise analysis of the amendments to the Income-tax Act by the Finance (No. 2) Act, 2024. Reflecting Taxmann’s expertise, this publication stands out for its accuracy and timely analysis.

The book is organised into four essential sections:

- Section-wise Commentary on the Finance (No. 2) Act, 2024 – An in-depth analysis of the latest amendments, providing practical insights into their implications

- Income Tax Practice Manual – A step-by-step guide designed for tax practitioners, covering key areas such as TDS, TCS, return filing, and assessment procedures

- Gist of Circulars and Notifications – A section-wise, organised summary providing easy access to the most current guidance

- Digest of Landmark Rulings – A concise overview of significant judicial decisions that have shaped the interpretation of the Income-tax Act

This book is essential for tax professionals, legal practitioners, chartered accountants, financial consultants, academicians, and students.

The Present Publication is the 34th Edition, authored by Taxmann’s Editorial Board, with the following highlights:

- [Comprehensive Commentary] Detailed analysis covering significant areas like capital gains, share buybacks, trust taxation, business income, deductions, and more

- [Practical Tools] Overview of compliance, assessments, and TDS/TCS procedures

- [Digest of Circulars and Notifications] A thorough summary of circulars and notifications from 1961 to June 2024.

- [Digest of Landmark Rulings] A summary of judicial decisions from 1922 to June 2024

Master Guide to Income Tax Rules | 31st Edition

Master Guide to Income Tax Rules is a comprehensive publication that stands out for its in-depth structured coverage and accuracy. This unique publication provides detailed Rule-wise commentary on the Income-tax Rules of 1962, setting a high standard for clarity and thoroughness that Taxmann is known for.

This book is tailored for tax professionals, accountants, legal practitioners, and students, providing the expertise needed to understand the complexities of the Income-tax Rules.

The Present Publication is the 31st Edition and incorporates all amendments till the Income-tax (Sixth Amendment) Rules, 2024. This book is authored by Taxmann’s Editorial Board with the following noteworthy features:

- [Para-wise Detailed Analysis] This book thoroughly examines every operative rule of the Income-tax Rules, 1962, with the underlying provisions of the Income-tax Act and the required compliances.

- [Statutory Background] Each rule is placed in context with its statutory provision, helping readers understand the intent and practical application of the law

- [Case Laws] Relevant judicial precedents of the Supreme Court, High Courts and Tribunals are included to aid in the interpretation and real-world application of the rules

- [Simplified Language] The rules are explained in clear, lucid and straightforward language, making the provisions accessible and easy to understand

- [Illustrations] Practical examples are provided to help clarify the more complex aspects of the rules, making them easier to understand

- [Gist of Circulars and Notifications] Summaries of all relevant and current circulars and notifications are linked to each rule, giving a complete picture of the law

The structure of the book is as follows:

- Rule-wise Commentary – Each rule is dissected to elucidate its applications and implications, supported by:

- Rule Number and Title – For quick reference

- Statutory Background – Discusses the legislative context and purpose

- Illustrations and Examples – Demonstrates practical applications in real-world scenarios

- Compliance Guidelines – Outlines specific compliance requirements for each rule

- Cross-referencing – Includes strategic cross-references to para numbers or annexures for easy navigation

- Supplementary Materials

- Annexes and Circulars – Contains full texts of critical circulars, notifications, and relevant statutory provisions, appropriately linked to corresponding rules

- Comprehensive List of Circulars/Notifications – A detailed list of all referenced documents, organised chronologically and indexed for ease of access

Direct Taxes Ready Reckoner | 48th Edition | AYs 2024 & 25 & 2025-26

Direct Taxes Ready Reckoner has been the trusted companion for tax professionals in India for over forty years. The 48th Edition, authored by Dr Vinod K. Singhania, is updated with the latest amendments from the Finance (No. 2) Bill, 2024, as passed by the Lok Sabha, applicable for Assessment Years 2024-25 and 2025-26. The key features include:

- [Focused Analysis] Clear, concise explanations of the Income-tax Act, with amendments integrated seamlessly

- [Amendments Overview] A comprehensive ‘Amendments at a Glance’ section providing illustrative examples of recent legislative changes

- [In-Depth Case Studies] Detailed analysis of complex provisions, such as capital gains tax, the withdrawal of indexation benefits, and the abolition of Angel Tax, etc.

- [Comprehensive Income Tax Act Coverage] Exhaustive commentary on all provisions, enriched with case laws and notifications

- [Alternative Tax Regime] Break-even tables and comparisons to guide taxpayers

- [Faceless Tax Proceedings] Summarised legal framework for modernised tax processes

- [User-Friendly Layout] Tabular presentations for quick reference covering tax audits, alternative regimes, and more

- [Accurate Tax Computations] Guidelines for accurate tax calculations across various income slabs

- [Ready Referencer] Quick access to the latest tax rates, TDS/TCS rates, due dates, and more

- This edition maintains a zero-error approach, making it one of the most reliable resources in direct taxation

Taxmann’s Editorial Board

At the heart of Taxmann Publications lies the Research & Editorial Team, established from a cadre of Chartered Accountants, Company Secretaries, and Lawyers. This group, operating under the guidance of Editor-In-Chief Mr Rakesh Bhargava, is the cornerstone of Taxmann’s commitment to delivering unparalleled content accuracy and reliability.

The team’s mission is anchored in the principles of the Six Sigma methodology, with a steadfast goal of eradicating errors and upholding the highest standards of excellence in all publications and research outputs. Their rigorous content development process is informed by core guidelines, ensuring every piece of work is authoritative and insightful. These guidelines include:

- Sourcing – All statutory materials are derived exclusively from authorized and credible sources, guaranteeing the integrity of the information provided

- Current Awareness – The team prioritizes keeping readers well-informed of the latest judicial and legislative developments, ensuring content is both timely and relevant

- Analytical Insights – Special emphasis is placed on crafting analytical pieces on topical, contentious, and impactful issues, aiding readers in comprehensively understanding the nuances and implications of recent events

- Clarity and Accuracy – Taxmann pledges that every publication is thorough, precise, and articulated with clarity, serving as a reliable reference for complex subjects

- Evidence-based Referencing – Assertions and analyses are meticulously backed with references to relevant sections, circulars, notifications, or citations, enhancing the content’s credibility

- Quality and Consistency – Adherence to the golden rules of grammar, style, and consistency is non-negotiable, ensuring a seamless and engaging reading experience

- Accessibility – The choice of font and size across all print and digital mediums is dictated by legibility and consistency, making information accessible to all readers

Vinod K. Singhania

Dr Vinod K. Singhania earned his PhD from the prestigious Delhi School of Economics in 1976. Dr Singhania has become a leading authority in his field, having expertise in corporate legislation and corporate economics, particularly in tax laws.

Over the years, he has been associated with numerous professional institutes and business organizations in India and internationally, contributing his expertise in various capacities.

A prolific author, Dr Singhania has penned numerous widely acclaimed books and developed software, all published by Taxmann. His scholarly contributions include over 300 research articles featured in prominent journals. Additionally, he has served as a resource person in more than 800 seminars worldwide, sharing his knowledge and insights with a global audience.

Reviews

There are no reviews yet.