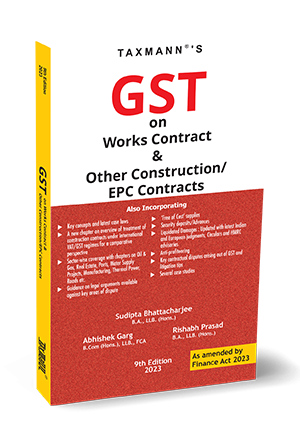

This book covers a broad spectrum of aspects in the context of works contracts. It provides an understanding of the impact of GST as applicable to ‘works contracts’ vis-à-vis a wide range of construction and EPC/O&M contracts or concession agreements. This book is a comprehensive and practical guide for tax specialists and generalist legal advisors.

Description

This book covers a broad spectrum of aspects in the context of works contracts. It provides an understanding of the impact of GST as applicable to ‘works contracts’ vis-à-vis a wide range of construction and EPC/O&M contracts or concession agreements.

This book is a comprehensive and practical guide for tax specialists and generalist legal advisors.

The Present Publication is the 9th Edition and has been amended by the Finance Act 2023. This book is authored by Sudipta Bhattacharjee, Rishab Prasad & Abhishek Garg, with the following noteworthy features:

- [30+ Crisp, Easily Readable Chapters] each explaining the concepts with several case-studies

- [Evolution of Concepts from the Pre-GST Era] have also been touched upon in the book to provide a comprehensive understanding

- [Sector-wise Coverage] which includes the following:

- Oil & Gas Sector

- Real Estate Sector

- Road/Highway Projects

- Ports

- Thermal and Solar Power Generation

- Large Manufacturing Plants

- Large Urban Water Supply Projects

- [Guidance on Available Legal Arguments] on critical areas of dispute such as:

- What can qualify as immovable property?

- Input Tax Credit related aspects as applicable to ‘works contracts’

- Impact on Advances/Security Deposits

- ‘Free of Cost’ Supplies

- Transitional Issues

- Anti-profiteering

- [Detailed Analysis] on the following topics:

- Analysis on the applicability of GST on liquidated damages with detailed reference to the updated legal position in the European Union/United Kingdom

- Practical Strategies vis-à-vis structuring various types of Construction/EPC Contracts

- Best practices for tax controversy management under GST

The detailed contents of the book are as follows:

- Introduction to the scheme of GST

- Evolution of ‘Works Contract’ Pre-GST

- Definition of ‘Works Contract’ under GST

- Overview of Treatment of Construction Contracts under International VAT/GST Regimes for a Comparative Perspective

- ‘Works Contract’ must pertain to ‘Immovable Property’ – What is ‘Immovable Property’?

- For a contract to qualify as a ‘Works Contract’, it must involve ‘Transfer of Property in Goods’ – What is ‘Transfer of Property in Goods’?

- ‘Composite’ and ‘Mixed Supply’ – Relevance under ‘Works Contract’

- Interplay between Composite Supply, Mixed Supply and Works Contract

- Classification of Services under GST and ‘Works Contract’

- Input Tax Credit for ‘Works Contract’

- Case Studies to practically understand whether a contract would qualify as a ‘Works Contract’

- Registration for Works Contractor under GST

- Time of Supply and Issuance of Invoice (Point of Taxation)

- Impact of GST on Advances/Security Deposits, etc.

- Valuation and ‘Free of Cost’ supplies by the customer

- Place of Supply

- Liquidated Damages under Works Contract & GST Implications

- GST Rates as Applicable on Various Types of Works Contracts

- Summarizing the Key Differences in ‘Works Contract’ in the Pre and Post-GST Era

- Transition provision under GST for Works Contract

- Tax Deduction at Source (‘TDS’)

- Works Contract and Implications in Oil & Gas Sectors

- Works Contract and Implications in Real Estate

- Works Contract and Implications for Roads/Highways

- Works Contracts and Implications on Ports

- Works Contracts and Implications on Thermal Power Generation

- Works Contract and Implications on Solar Power Generation

- Works Contract and Implications on Large Manufacturing Plants

- Works Contract Implications on Large Water Supply Projects

- GST and Anti-profiteering

- Practical Strategies vis-à-vis Structuring of Various Types of Works Contracts under GST

- What happens to the ‘No-Income Tax’ position for Offshore Supplies under a Single EPC Contract post-GST?

- Best Practices for Tax Controversy Management under GST

Sudipta Bhattacharjee

Recognized in 2020 by the Businessworld Legal magazine amongst the top 40 of India’s finest lawyers and legal influencers under the age of 40 [#BWLegal40under40], Sudipta is a Partner at a reputed Tier-1 law firm’s Delhi-NCR office. He has 17 years of experience providing strategic tax and allied commercial-legal advisory services to clients in diverse sectors and structuring, drafting, reviewing, and negotiating various contracts.

He is a qualified lawyer who graduated from the prestigious National University of Juridical Sciences, Kolkata. Sudipta specializes in all pre-GST Indian indirect taxes, including Customs, Excise, Service Tax, GST, and contract documentation-related services. He has provided strategic advice on the GST transition and implementation in India to businesses across sectors. He has undertaken several training sessions educating clients and the general public about the impact of GST on their key business processes. Sudipta has also led VAT impact assessments for business conglomerates in Kuwait relating to the proposed VAT introduction in middle-east (Gulf Co-operation Council countries).

Sudipta regularly speaks at prestigious conferences and has written extensively on GST and other tax issues in newspapers like Business Standard and Economic Times.

Sudipta has been recognized as ‘Highly Regarded’ in Indirect Tax by World Tax (The comprehensive guide to the world’s leading tax firms) since 2020 and has been repeatedly recognized as an ‘Indirect Tax Leader’ for India by the International Tax Review since 2017. He has also been ranked as a ‘Leading Lawyer’ for ‘Tax’ in Chambers & Partners and Legal 500 Asia-pacific (India) 2022 Edition and the RSG India report on law firms, 2020.

Abhishek Garg

Abhishek is a practising lawyer and holds dual professional qualifications of

a Chartered Accountant and an Advocate. He is a Commerce Graduate from the prestigious Shri Ram College of Commerce and has done his Law at Campus Law Center, Faculty of Law, Delhi. He is a Fellow Member of the Institute of Chartered Accountants of India (ICAI).

He has developed his niche in tax and corporate laws while working with top-tier law firms like Shardul Amarchand Mangaldas, Lakshmikumaran & Sridharan and Advaita Legal. He has experience handling Direct and Indirect Tax Litigation and Company law matters across all judicial and quasi-judicial fora. He is actively involved in advising and training various companies, industries and professionals in relation to taxation and corporate and commercial laws.

Abhishek is also visiting faculty on Indirect Tax Laws and Insolvency and Bankruptcy laws at ICAI. He is also a regular speaker at various conferences and CA study circles. He is practising through his founded law firm AGS Legal which is based in Delhi.

Rishabh is an experienced tax lawyer working in a highly reputed tax counsel’s chambers and based out of Delhi. He graduated from the prestigious National University of Juridical Sciences, Kolkata, in 2015 and has worked extensively in all areas of indirect tax, including GST, Service Tax, Customs, FTP and International Trade Laws. Rishabh has also been deeply involved with the GST transition in India. He has regularly advised various corporate houses on strategic and typical day-to-day GST issues, including transaction structuring. Further, Rishabh has been a part of multiple transnational assignments for business conglomerates in relation to the impending transition to the VAT regime in the Middle East (Gulf Co-operation Council countries).

![Taxmann's - Bharatiya Nyaya Sanhita 2023 | Flexi-bound [Pocket] Edition](https://cashapers.in/wp-content/uploads/2024/08/Book1.1.jpg)

Reviews

There are no reviews yet.