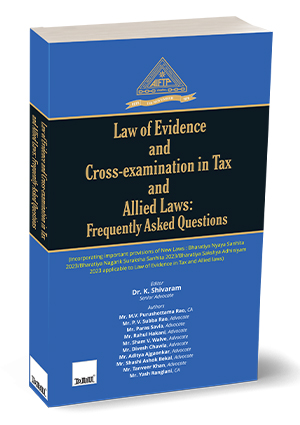

This handbook offers an in-depth understanding of the law of evidence and cross-examination within tax and related legal areas. It is presented in a Q&A format to tackle a broad spectrum of topics across various tax statutes.

The content is methodically divided into fifteen chapters dedicated to different facets of tax law and evidence. These chapters dissect procedural and evidentiary aspects ranging from basic evidence concepts in the Income-tax Act 1961 to complex topics in International Taxation and Transfer Pricing. The handbook addresses indirect tax procedures under several acts, including the GST Act, Customs Act, and more specialised areas like Benami Transactions and the Prevention of Money Laundering Act (PMLA). It also covers aspects of the Information Technology Act 2000. It introduces new criminal law frameworks under the Bharatiya Nyaya Sanhita, 2023, Bharatiya Nagarik Suraksha Sanhita, 2023, Bharatiya Sakshya Adhiniyam, 2023, and the Indian Limitation Act, 1963.

This book is tailored for tax consultants and legal advisors and serves as a practical guide for applying the law of evidence in tax-related proceedings, including:

- Assessments

- Re-assessments

- Appeals

It is especially pertinent for those practising in virtual assessment and appeal environments, where precise evidence handling is crucial.

The Present Publication is the Latest Edition, commissioned by the All India Federation of Tax Practitioners and published exclusively by Taxmann. It is edited by Dr K. Shivaram, and authored by CA. M.V. Purushottama Rao, Adv. P.V. Subba Rao, Adv. Paras Savla, Adv. Rahul Hakani, Adv. Sham V. Walve, Adv. Divesh Chawla, Adv. Aditya Ajgaonkar, Adv. Shashi Ashok Bekal, Adv. Tanveer Khan and CA. Yash Ranglani. The noteworthy features of the book are as follows:

- [Practical Q&A Format] with a focus on complex legal issues in tax (both direct and indirect) and various economic laws

- [Structured Format] Each chapter addresses specific legislation, discussing the following:

- Core Concepts

- Application Challenges

- Procedural Aspects

- [Detailed Analysis] on topics such as:

- Intricate aspects of evidence and cross-examination techniques

- Evidentiary challenges and legal strategies in dealing with documents such as microfilms, computer printouts, and electronic records

- Advanced topics like transfer pricing, General Anti Avoidance Rule (GAAR), and the role of evidence in international transactions

- New Criminal Law Framework:

- Bharatiya Nyaya Sanhita

- Bharatiya Nagarik Suraksha Sanhita

- Bharatiya Sakshya Adhiniyam

- [Expert Authorship] Authored by 10+ stalwarts in the field, the book encapsulates the depth of experience and knowledge of its contributors, who are recognised professionals in law and taxation.

The structure of the book is as follows:

- [Basics to Advanced Topics] Starts with fundamental concepts of evidence and moves to complex issues in re-assessment proceedings, international transactions, and cross-border issues, including transfer pricing and GAAR

- [Cross-Examination Techniques] Dedicated sections on the art and strategic approach to cross-examination in tax litigation, with do’s and don’ts to aid practitioners in effective advocacy

- [Special Focus on New Legislation] Detailed analysis of the BNS, BSA, and their implications on current tax practices and evidence handling

- [Practical Approach] Each section includes practical questions and answers that help clarify the practical application of theoretical knowledge

The contents of the book are as follows:

- Income-tax Act, 1961 – Evidence – Concepts and Basics

- This chapter introduces and discusses the definition and basic features of ‘Evidence’ outlined in the Bharatiya Sakshya Adhiniyam, 2023. An analysis of how courts interpret ‘Evidence’ under the Evidence Act, 1872, and the relevance of these interpretations within the context of the Income-tax Act, 1961

- FAQ.1 – FAQ.18 – It provides a detailed analysis covering the provisions of the Income-tax Act that refer to ‘Evidence,’ including direct and indirect references to the Evidence Act and the Bharatiya Sakshya Adhiniyam, 2023. The chapter discusses the evidentiary value of confessional statements, the credibility assessments by Assessing Officers, and the legalities surrounding cash credits, among other pivotal discussions

- This chapter introduces and discusses the definition and basic features of ‘Evidence’ outlined in the Bharatiya Sakshya Adhiniyam, 2023. An analysis of how courts interpret ‘Evidence’ under the Evidence Act, 1872, and the relevance of these interpretations within the context of the Income-tax Act, 1961

- Income-tax Act, 1961 – Rules of Evidence

- This chapter discusses the various types of assessments under the Income-tax Act, 1961, such as Summary Assessment, Scrutiny Assessment, Best Judgment Assessment, and Faceless Assessment. It examines the powers conferred upon Income-tax Authorities to collect evidence and the circumstances under which Assessing Officers can accept or reject claims made by assessee

- FAQ.19 – FAQ.44 – It provides an extensive analysis of how evidence plays a critical role in the assessment process, including the manner and mode of service and communication of notices to the assessee. The chapter also addresses the evidentiary value of third-party statements and the judicial requirement of notice or summons service

- FAQ.45 – FAQ.90 – It further discusses the nuances of evidence in income tax assessments, covering a wide range of topics from the justification of sham documents in assessment proceedings to the scope of protective income-tax assessments under the Act. This segment explores the legal basis for adjustments, the right of cross-examination, and the implications of various assessment methodologies

- This chapter discusses the various types of assessments under the Income-tax Act, 1961, such as Summary Assessment, Scrutiny Assessment, Best Judgment Assessment, and Faceless Assessment. It examines the powers conferred upon Income-tax Authorities to collect evidence and the circumstances under which Assessing Officers can accept or reject claims made by assessee

- Income-tax Act, 1961 – Law of Evidence – Re-assessment Proceedings

- This chapter focuses on the nuanced legal frameworks and judicial interpretations relevant to re-assessment under the Income-tax Act, 1961, especially in light of the amendments effective April 1, 2021. It details principles of natural justice and procedural requirements for a valid re-assessment

- FAQ.91 – FAQ.125 – It analyses the validity of re-assessment notices, the authority of Assessing Officers in the re-assessment process, and the judicial and procedural safeguards, including the assessment of fresh materials and the role of judicial notices in re-assessment scenarios

- FAQ.126 – FAQ.129 – It concludes the re-assessment discussion by addressing the judicial precedents set for re-assessment under the Income-tax Act, focusing on the limits of the Assessing Officer’s powers and the legal requirements for a valid re-assessment. It includes topics on the interpretation of limitation periods and the effects of court findings on re-assessment procedures

- This chapter focuses on the nuanced legal frameworks and judicial interpretations relevant to re-assessment under the Income-tax Act, 1961, especially in light of the amendments effective April 1, 2021. It details principles of natural justice and procedural requirements for a valid re-assessment

- Income-tax Act, 1961 – Law of Evidence – Search, Seizure and Survey Proceedings

- This chapter examines the procedures and legal precedents governing search, seizure, and survey under the Income-tax Act. This chapter also elaborates on the evidentiary values assigned to documents, electronic records, and statements collected during these operations

- FAQ.130 – FAQ.152 – It analyses the admissibility and reliance on evidence gathered from search and seizure operations, including the impact of admissions made during searches, the legal status of documents seized, and the procedures following search actions for assessing undisclosed income

- FAQ.153 – FAQ.155 – It concludes the discussion on search and seizure by examining the evidentiary value of statements made post-search actions, the legal standing of such statements in court, and the assessability of surrendered income post-retraction of a statement made under duress or mistake

- This chapter examines the procedures and legal precedents governing search, seizure, and survey under the Income-tax Act. This chapter also elaborates on the evidentiary values assigned to documents, electronic records, and statements collected during these operations

- Income-tax Act, 1961 – Law of Evidence – Appellate Proceedings

- This chapter discusses the appellate mechanisms within the Income-tax framework, detailing the powers available to appellate authorities in accepting and evaluating new evidence and the procedural norms for a fair appellate review

- FAQ.156 – FAQ.192 – It reviews the application of additional evidence in appeals, the criteria for admitting fresh evidence, and the procedural expectations from the appellants at various appellate levels, including the strategic use of evidence in influencing appellate decisions

- FAQ.193 – FAQ.196 – It concludes the appellate discussion by delving into the powers of the Income-tax Appellate Tribunal, including the admission of new evidence, the tribunal’s duty to inquire independently, and the scope of directions it can issue while deciding appeals. It explores the legal remedies available against procedural errors and the recalibration of appellate decisions based on new facts or evidence

- This chapter discusses the appellate mechanisms within the Income-tax framework, detailing the powers available to appellate authorities in accepting and evaluating new evidence and the procedural norms for a fair appellate review

- Income-tax Act, 1961 – Law of Evidence – International Transaction, Transfer Pricing and General Anti-Avoidance Rules (GAAR)

- This chapter covers evidence considerations in international tax disputes, transfer pricing adjustments, and the application of GAAR, outlining the types of evidence pivotal in these contexts and their interpretative challenges

- FAQ.197 – FAQ.240 – It provides a detailed discussion on the evidentiary requirements for supporting transfer pricing methodologies, the role of tax residency certificates in treaty benefits, and the evidential implications of GAAR in structuring international transactions

- This chapter covers evidence considerations in international tax disputes, transfer pricing adjustments, and the application of GAAR, outlining the types of evidence pivotal in these contexts and their interpretative challenges

- Rule of Evidence in Indirect Tax Proceedings (Central Goods and Services Tax Act, 2017)

- This chapter analyses the evidentiary aspects under the GST framework, addressing the documentary and procedural requisites for registration, claims, and compliance, as well as the powers of the GST appellate tribunal concerning evidence

- FAQ.241 – FAQ.292 – It examines issues such as the acceptability of electronic records, the implications of non-compliance with summons, and the procedural norms for the submission and adjudication of evidence in GST proceedings

- FAQ.293 – FAQ.303 – It discusses advanced topics in GST-related evidence, including using digital records in proceedings, the admissibility of electronic records, and the legal consequences of destroying or secreting documents. This segment also covers procedural questions related to the electronic submission of documents and the automatic acceptance of digital records by authorities

- This chapter analyses the evidentiary aspects under the GST framework, addressing the documentary and procedural requisites for registration, claims, and compliance, as well as the powers of the GST appellate tribunal concerning evidence

- Customs Act, 1962 – Law of Evidence

- This chapter investigates the evidence law as it applies to the Customs Act, including the admissibility of statements under duress, the role of digital records, and the judicial review of evidentiary decisions made by customs authorities

- FAQ.304 – FAQ.323 – It focuses on the principles governing the collection and use of evidence in customs proceedings, the challenges in proving the illicit nature of goods, and the legal thresholds for the admissibility of electronic evidence in customs violations

- This chapter investigates the evidence law as it applies to the Customs Act, including the admissibility of statements under duress, the role of digital records, and the judicial review of evidentiary decisions made by customs authorities

- Law of Evidence – Benami Transactions (Prohibition) Act

- This chapter explores the evidential challenges and legal interpretations associated with benami transactions, particularly the determination of true ownership and the applicability of procedural laws in benami property disputes

- FAQ.324 – FAQ.354 – It discusses the statutory definitions of benami transactions, the evidentiary burdens placed on parties, and the role of evidence in adjudicating disputes under the Benami Transactions Prohibition Act

- This chapter explores the evidential challenges and legal interpretations associated with benami transactions, particularly the determination of true ownership and the applicability of procedural laws in benami property disputes

- Law of Evidence – Prevention of Money-Laundering Act, 2002

- This chapter discusses the unique evidence issues in money laundering cases under the PMLA, including the treatment of confessions, the admissibility of illegally obtained evidence, and the presumptions about the burden of proof

- FAQ.355 – FAQ.366 – It analyses the procedural nuances and evidentiary standards required to establish money laundering under the PMLA, including the implications of the act’s overriding effect over other legal provisions

- This chapter discusses the unique evidence issues in money laundering cases under the PMLA, including the treatment of confessions, the admissibility of illegally obtained evidence, and the presumptions about the burden of proof

- Information Technology Act, 2000 – Law of Evidence

- This chapter reviews the interplay between the IT Act and tax law, focusing on the admissibility of electronic records, the legal requirements for electronic signatures, and the challenges associated with digital evidence in tax proceedings

- FAQ.367 – FAQ.383 – It covers the critical aspects of electronic evidence under the IT Act, including the standards for certifying digital records, the admissibility of communications

- This chapter reviews the interplay between the IT Act and tax law, focusing on the admissibility of electronic records, the legal requirements for electronic signatures, and the challenges associated with digital evidence in tax proceedings

- Bharatiya Nyaya Sanhita, 2023 – Law of Evidence

- This chapter examines the newly instituted Bharatiya Nyaya Sanhita, 2023, highlighting its impact on the adjudication processes, particularly in abetment, criminal conspiracy, and the furnishing of false information. It discusses the definitions, implications, and evidentiary requirements set forth by the new legal framework

- FAQ.384 – FAQ.405 – It analyses the detailed legal questions regarding abetment, the nuances of criminal conspiracy, the legal responsibilities surrounding false information, and the procedural implications for evidentiary submissions under the Bharatiya Nyaya Sanhita.

- This chapter examines the newly instituted Bharatiya Nyaya Sanhita, 2023, highlighting its impact on the adjudication processes, particularly in abetment, criminal conspiracy, and the furnishing of false information. It discusses the definitions, implications, and evidentiary requirements set forth by the new legal framework

- Bharatiya Sakshya Adhiniyam, 2023 – Income-tax Act, 1961

- This chapter discusses the implications of the Bharatiya Sakshya Adhiniyam, 2023, for evidence handling within the Income-Tax Act. It addresses how this new evidence act interfaces with tax law, focusing on admissibility, evidentiary burdens, and judicial practices.

- FAQ.406 – FAQ.426 – It thoroughly examines court procedures, evidentiary criteria, and legal presumptions under the Bharatiya Sakshya Adhiniyam as applied to tax law. This includes discussions on the admission of electronic evidence, the roles of public servants, and the importance of expert opinions in tax litigation

- FAQ.427 – Q.448 – It closes the discussion on the Bharatiya Sakshya Adhiniyam’s application to tax law by focusing on the practical aspects of evidence handling in court. This includes the distinction between primary and secondary evidence, the relevance of public and private documents, and the legal implications of electronic evidence. It addresses the burden of proof, the doctrine of estoppel, and the protection afforded to communications between a lawyer and their client

- This chapter discusses the implications of the Bharatiya Sakshya Adhiniyam, 2023, for evidence handling within the Income-Tax Act. It addresses how this new evidence act interfaces with tax law, focusing on admissibility, evidentiary burdens, and judicial practices.

- Indian Limitation Act, 1963 – Law of Evidence

- This chapter focuses on the interaction between the Indian Limitation Act, 1963, and tax law, particularly how time limitations can influence the admissibility and effectiveness of evidence in tax proceedings. It covers the acknowledgement of debts, the effects of financial statements as acknowledgements, and the legal precedents that govern these relationships

- FAQ.449 – FAQ.458 – It investigates various scenarios under the Limitation Act that affect the tax law, such as the impact of an acknowledgement in writing on the limitation period and whether electronic communications can constitute an acknowledgement. This chapter also discusses the consequences of late filings and the legal nuances of appeals related to limitation issues

- This chapter focuses on the interaction between the Indian Limitation Act, 1963, and tax law, particularly how time limitations can influence the admissibility and effectiveness of evidence in tax proceedings. It covers the acknowledgement of debts, the effects of financial statements as acknowledgements, and the legal precedents that govern these relationships

- Cross-Examination – Law of Evidence – Do’s and Don’ts During Cross-Examination

- This chapter provides a comprehensive guide on the proper procedures and strategic considerations for cross-examination within tax litigation. It outlines best practices, potential pitfalls, and the critical importance of cross-examination in establishing the credibility of evidence

- FAQ.459 – Q.472 – It offers a thorough overview of examination techniques, the legal value of confessions made during searches, and the implications of denying an opportunity for cross-examination. It also discusses the procedural rights and responsibilities that govern the presence of witnesses and the admissibility of their statements in tax disputes

- This chapter provides a comprehensive guide on the proper procedures and strategic considerations for cross-examination within tax litigation. It outlines best practices, potential pitfalls, and the critical importance of cross-examination in establishing the credibility of evidence

![Taxmann's - Bharatiya Sakshya Adhiniyam 2023 | Flexi-bound [Pocket] Edition](https://cashapers.in/wp-content/uploads/2024/08/Book.1.22.jpg)

![Taxmann's - Bharatiya Nyaya Sanhita 2023 | Flexi-bound [Pocket] Edition](https://cashapers.in/wp-content/uploads/2024/08/Book1.1.jpg)

Reviews

There are no reviews yet.