Description

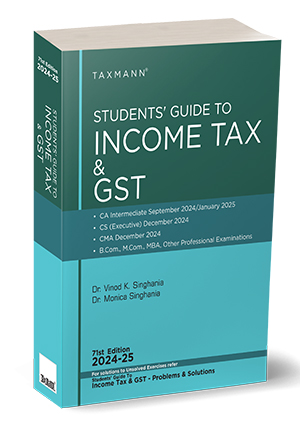

Taxmann’s flagship publication for students on Income Tax & GST Law(s) is designed to bridge the gap between theory and application. Written in simple language, it explains legal provisions step-by-step with suitable illustrations, avoiding paraphrasing and legal jargon.

This book is an authentic, up-to-date, and amended textbook on Income Tax & GST for students of CA Intermediate (Sept. 2024/Jan. 2025), CS Executive (Dec. 2024), CMA (Dec. 2024), B.Com., M.Com., MBA and other professional examinations.

The Present Publication is the 71st Edition | 2024-25 and amended upto 15th June 2024. This book is authored by Dr Vinod K. Singhania & Dr Monica Singhania, with the following noteworthy features:

- [Comprehensive Coverage] of this book includes:

- Unit 1 – Income Taxes

- Unit 2 – GST

- [Extensive Problem Sets] Over 500 solved problems with an equal number of unsolved exercises

- [Past Exam Questions] Includes questions set for CA (Inter/IPCC) examinations over the last five years, with solutions for both theory and practical questions

- Income Tax problems are solved as per the law applicable for A.Y. 2024-25

- GST problems are solved according to the law as amended up to June 15, 2024

- [Features] of this book are as follows:

- [Student-Friendly Approach] The book adopts a ‘teach yourself’ technique, enhancing the learning process with a clear, step-by-step explanation of legal provisions

-

-

- [Illustrative Problems] Each chapter includes analytical discussions supported by original problems, fostering a deeper understanding of complex provisions

- [Practical Exercises] To build confidence in solving practical questions, solved problems are followed by unsolved exercises with answers provided in the appendix

- For Solutions to the unsolved exercises, students may refer to the 29th Edition of Taxmann’s Students’ Guide to Income Tax including GST Problems & Solutions

- [Professional Exam Focus] Sections marked with a ➠ symbol cater specifically to professional exam aspirants while also being beneficial for high-achieving university students

- Follows the Six-Sigma Approach to achieve the benchmark of ‘Zero-Error’

The contents of the book are as follows:

- Income Tax

- Basic concepts that one must know

- Residential status and its effect on tax incidence

- Income that is exempt from tax

- Income under the head ‘Salaries’ and its computation

- Income under the head’ Income from house property’ and its computation

- Income under the head’ Profits and gains of business or profession’ and its computation

- Income under the head’ Capital gains’ and its computation

- Income under the head’ Income from other sources’ and its computation

- Clubbing of income

- Set-off and carry forward of losses

- Permissible deductions from gross total income

- Meaning of agriculture income and its tax treatment

- Individuals – Computation of taxable income

- Hindu undivided families – Computation of taxable income

- Firms and association of persons – Computation of taxable income

- Return of income

- Advance payment of tax

- Deduction and collection of tax at source

- Interest payable by assessee/Government

- GST

- Basic concepts of GST

- Concept of Supply

- Levy of GST

- Exemptions from GST

- Place of supply

- Time of supply

- Value of taxable supply

- Reverse charge mechanism

- Input tax credit

- Composition Scheme and Alternative Composition Scheme

- Registration

- Tax invoice, credit and debit notes

- Returns, tax payment and interest

- Provisions governing Real Estate Services

- Problems on GST

- Appendix

- Tax Rates

- Question set for CA (Intermediate) Examinations and Answers

- Depreciation rates for power-generating units

- Answers to unsolved exercises

-

About the author

Vinod K. Singhania

Dr. Vinod K. Singhania got his PhD from the Delhi School of Economics in 1976. His field of special interest includes all facets of corporate legislation and corporate economics, especially tax laws.

Associated in different capacities with several professional institutes and business houses in India and abroad, Dr. Singhania has authored many popular books and software published by Taxmann.

He has to his credit more than 300 research articles that have appeared in leading journals. He has been a resource person in over 800 seminars in India and abroad.

Monica Singhania

Dr. Monica Singhania is a Professor at Faculty of Management Studies, University of Delhi. She is a post-graduate from the Delhi School of Economics and a Fellow Member of the Institute of Chartered Accountants of India. She has the distinction of being placed on the merit list of the examinations conducted by both the university and the Institute.

She has been awarded a PhD in corporate taxation from the University of Delhi. She is the author of 7+ books on direct tax laws and several research papers published in leading journals.

Reviews

There are no reviews yet.