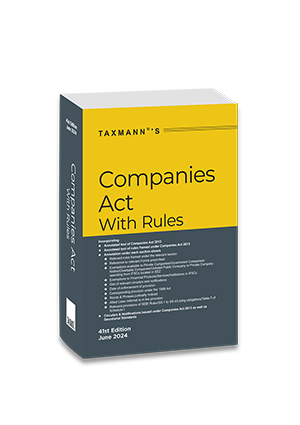

This is the most authentic and comprehensive book on the Companies Act, 2013, in a Pocket Paperback format. It covers amended, updated, and annotated texts. It includes 55+ Rules, Circulars, Notifications, and Secretarial Standards. Unique features include detailed annotations under each section, highlighting relevant rules, forms, exemptions, and judicially noticed words and phrases.

Description

This is the most authentic and comprehensive book on the Companies Act, 2013, in a Pocket Paperback format. It covers the amended, updated & annotated text of the following:

- Companies Act, 2013 [as amended up to date] with annotations

- Provisions of other Acts referred to in the Companies Act, 2013

- Words & Phrases Judicially Noticed

- 55+ Rules framed thereunder with annotations

- Circulars & Notifications issued under the Companies Act, 2013

- Secretarial Standards

What sets it apart is the presentation/coverage of the Companies Act with corresponding Rules, Circulars & Notifications. In other words, the Annotation under each Section shows:

- Relevant Rules framed under the relevant Section

- Reference to relevant Forms prescribed

- Exemptions available to Private Companies, Government Companies, Nidhis, Charitable Companies, Unlisted Public Company, and Private Companies operating from IFSCs located in SEZ

- Exemptions to Financial Products/Services/Institutions in IFSCs

- Gist of relevant Circulars & Notifications

- Date of enforcement of provisions

- Corresponding provisions under the 1956 Act

- Words & Phrases judicially noticed

- Allied Laws referred to in the provision

- Relevant provisions of SEBI Rules/SS-1 to SS-4/Listing Obligations/Table F of Schedule I

The Present Publication is the 41st Edition & updated upto 10th June 2024. This book is edited by Taxmann’s Editorial Board, with the following noteworthy features:

- [Taxmann’s series of Bestseller Books] on Company Laws

- [Follows the Six-Sigma Approach] to achieve the benchmark of ‘zero error.’

The contents of the book are as follows:

- List of Rules/Regulations

- Alphabetical list of Rules/Regulations

- Exemptions:

- Private Companies

- Section 8 Companies

- Nidhis

- Government Companies

- Private Company that is licensed to operate by RBI, SEBI, and IRDA from the International Financial Services Centre located in an approved multi-services SEZ set-up under the SEZ Act

- Unlisted public company that is licensed to operate by RBI, SEBI, and IRDA from the International Financial Services Centre located in an approved multi-services SEZ set-up under the SEZ Act

- Financial Products, Financial Services, or Financial Institutions in an International Financial Services Centre (IFSC)

- List of Circulars & Notifications

- Companies Act, 2013 with Rules

- Arrangement of Sections

- Annotated text of the Companies Act, 2013 as amended up to date

- Appendix I: Provisions of other Acts referred to in Companies Act, 2013

- Appendix II: Words & Phrases Judicially noticed

- Subject Index

- Rules framed under the Companies Act, 2013

- Key to Prescribed Forms

- Companies (Specification of Definitions Details) Rules, 2014

- Companies (Incorporation) Rules, 2014

- Companies (Prospectus and Allotment of Securities) Rules, 2014

- Companies (Issue of Global Depository Receipts) Rules, 2014

- Companies (Share Capital and Debentures) Rules, 2014

- Companies (Acceptance of Deposits) Rules, 2014

- Companies (Registration of Charges) Rules, 2014

- Companies (Management and Administration) Rules, 2014

- Companies (Declaration and Payment of Dividend) Rules, 2014

- Companies (Accounts) Rules, 2014

- Companies (Filing of Documents and Forms in Extensible Business Reporting Language) Rules, 2015

- Companies (Audit and Auditors) Rules, 2014

- Companies (Corporate Social Responsibility Policy) Rules, 2014

- Companies (Appointment and Qualification of Directors) Rules, 2014

- Companies (Meetings of Board and its Powers) Rules, 2014

- Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014

- Companies (Inspection, Investigation, and Inquiry) Rules, 2014

- Companies (Authorised to Register) Rules, 2014

- Companies (Registration of Foreign Companies) Rules, 2014

- Companies (Registration Offices and Fees) Rules, 2014

- Nidhi Rules, 2014

- National Company Law Tribunal Rules, 2016

- National Company Law Appellate Tribunal Rules, 2016

- National Company Law Tribunal (Salary, Allowances and Other Terms and Conditions of Service of President and Other Members) Rules, 2015

- National Company Law Appellate Tribunal (Salaries and Allowances and Other Terms and Conditions of Service of the Chairperson and Other Members) Rules, 2015

- Companies (Adjudication of Penalties) Rules, 2014

- Companies (Miscellaneous) Rules, 2014

- Companies (Cost Records and Audit) Rules, 2014

- Depository Receipts Scheme, 2014

- Companies (Indian Accounting Standards) Rules, 2015

- Companies (Accounting Standards) Rules, 2021

- Investor Education and Protection Fund Authority (Appointment of Chairperson and Members, Holding of Meetings and Provision for Offices and Officers) Rules, 2016

- Companies (Compromises, Arrangements, and Amalgamations) Rules, 2016

- Companies (Mediation and Conciliation) Rules, 2016

- Companies (Removal of Names of Companies from the Register of Companies) Rules, 2016

- Companies (Transfer of Pending Proceedings) Rules, 2016

- Investor Education and Protection Fund Authority (Accounting, Audit, Transfer and Refund) Rules, 2016

- National Company Law Tribunal (Procedure for Reduction of Share Capital of Company) Rules, 2016

- Tribunal Reforms Act, 2021

- Conditions of Service of Chairperson and Members of Tribunals, Appellate Tribunals, and Other Authorities

- Tribunal (Conditions of Service) Rules, 2021

- Companies (Arrests in Connection with Investigation by Serious Fraud Investigation Office) Rules, 2017

- Companies (Registered Valuers and Valuation) Rules, 2017

- Companies (Restriction on Number of Layers) Rules, 2017

- Condonation of Delay Scheme, 2018

- National Financial Reporting Authority (Manner of Appointment and other Terms and Conditions of Service of Chairperson and Members) Rules, 2018

- Companies (Significant Beneficial Owners) Rules, 2018

- Investor Education and Protection Fund Authority (Form of Annual Statement of Accounts) Rules, 2018

- Investor Education and Protection Fund Authority (Form and Time of Preparation of Annual Report) Rules, 2018

- Specified Companies (Furnishing of Information about Payment to Micro and Small Enterprise Suppliers) Order, 2019

- National Financial Reporting Authority Rules, 2018

- National Financial Reporting Authority (Meeting for Transaction of Business) Rules, 2019

- National Financial Reporting Authority (Recruitment, Salary, Allowances and Other Terms and Conditions of Service of Secretary, Officers and Other Employees of Authority) Rules, 2019

- Companies (Creation and Maintenance of Data Bank of Independent Directors) Rules, 2019

- Companies (Winding-up) Rules, 2020

- Companies (Auditor’s Report) Order, 2020

- National Company Law Tribunal and National Company Law Appellate Tribunal (Procedure for Investigation of Misbehaviour or Incapacity of Chairperson, President and Other Members) Rules, 2020

- Producer Companies Rules, 2021

- National Financial Reporting Authority appointment of Part-time Member Rules, 2022

- Companies (Listing of Equity Shares in Permissible Jurisdictions) Rules, 2024

- Circulars & Notifications

- Circulars & Notifications issued under the Companies Act, 2013

Taxmann’s Editorial Board

At the heart of Taxmann Publications lies the Research & Editorial Team, established from a cadre of Chartered Accountants, Company Secretaries, and Lawyers. This group, operating under the guidance of Editor-In-Chief Mr Rakesh Bhargava, is the cornerstone of Taxmann’s commitment to delivering unparalleled content accuracy and reliability.

The team’s mission is anchored in the principles of the Six Sigma methodology, with a steadfast goal of eradicating errors and upholding the highest standards of excellence in all publications and research outputs. Their rigorous content development process is informed by core guidelines, ensuring every piece of work is authoritative and insightful. These guidelines include:

- Sourcing – All statutory materials are derived exclusively from authorized and credible sources, guaranteeing the integrity of the information provided

- Current Awareness – The team prioritizes keeping readers well-informed of the latest judicial and legislative developments, ensuring content is both timely and relevant

- Analytical Insights – Special emphasis is placed on crafting analytical pieces on topical, contentious, and impactful issues, aiding readers in comprehensively understanding the nuances and implications of recent events

- Clarity and Accuracy – Taxmann pledges that every publication is thorough, precise, and articulated with clarity, serving as a reliable reference for complex subjects

- Evidence-based Referencing – Assertions and analyses are meticulously backed with references to relevant sections, circulars, notifications, or citations, enhancing the content’s credibility

- Quality and Consistency – Adherence to the golden rules of grammar, style, and consistency is non-negotiable, ensuring a seamless and engaging reading experience

- Accessibility – The choice of font and size across all print and digital mediums is dictated by legibility and consistency, making information accessible to all readers

Reviews

There are no reviews yet.