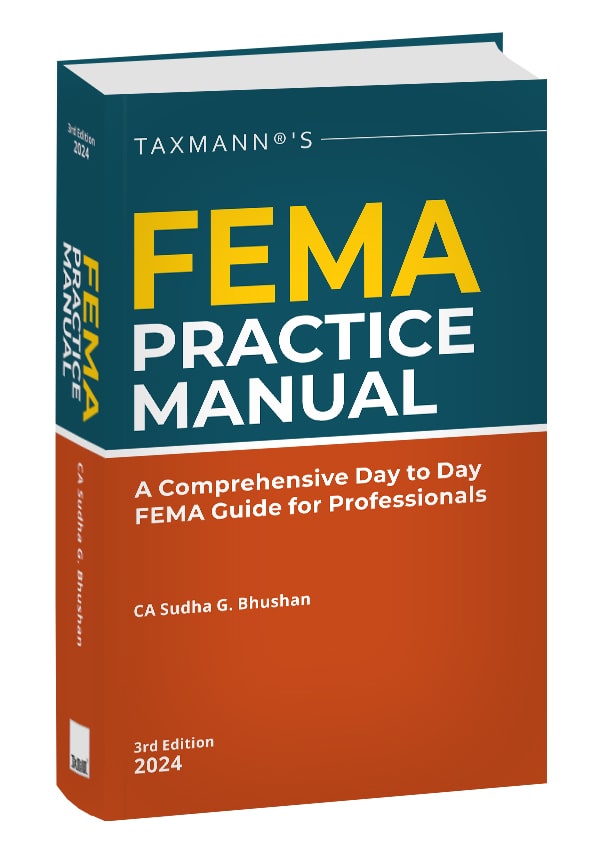

This book simplifies the fundamentals of FEMA and provides comprehensive coverage of its laws and regulations. It offers detailed commentary on various sections, rules, and regulations, providing a complete guide to foreign investment provisions. It is ideal for professionals, CFOs, and AD banks and includes practical examples, user-friendly explanations, and up-to-date amendments. This book is essential for effectively managing Foreign Exchange law in India.

Description

This book aims to simplify the fundamentals while providing exhaustive coverage of the relevant laws and regulations. It provides a comprehensive commentary on various sections, rules, and regulations under the Foreign Exchange Management Act (FEMA), making it a complete guide to foreign investment provisions.

This book is a comprehensive resource for professionals and Authorized Dealer (AD) banks, enabling effective management and implementation of Foreign Exchange law in India. It is a one-stop solution for:

- Professionals, including Chartered Accountants, Company Secretaries, Cost Accountants, and Lawyers

- Chief Financial Officers (CFOs) of multinational and Indian companies

- Authorised Dealer Banks

- Students

- Individuals interested in international transactions

The Present Publication is the 3rd Edition, authored by CA Sudha G. Bhushan. It is amended up to 7th June 2024, with the following noteworthy features:

- [In-depth Analysis] Detailed commentary on every section of FEMA, providing a thorough understanding of the law

- [Essential Resource] A must-have for persons managing trade or capital account transactions

- [Clear Guidance] Simplifies various provisions with easy-to-understand language and practical examples based on real case studies

- [Key Concepts Explained] Breaks down essential concepts like Residential Status and Capital/Current Account transactions with numerous examples

- [User-friendly Approach] Includes pictorial representations, checklists, examples, case studies, and RBI compounding orders to make complex laws comprehensible

- [Practical Focus] Provides detailed guidelines and procedures for transactions, making it easy to understand and apply the law

The contents of the book are as follows:

- [Fundamentals]

- This division covers the historical background and regulatory framework of FEMA, illustrating the paradigm shift from FERA to FEMA

- It includes detailed commentary on current and capital account transactions, currency management, and the roles of regulatory bodies like the Reserve Bank of India (RBI) and the Central Government

- This division also explains the balance sheet approach to evaluate transactions under FEMA and provides guidelines on maintaining foreign currency accounts

- [Foreign Investment]

- This unit provides an in-depth analysis of foreign investment regulations, including Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI)

- It discusses the governing regulations, types of foreign investments, entry routes, pricing methodologies, and downstream investments, offering practical insights for effective compliance and management

- [Cross Border Assets]

- This unit focuses on the acquisition and transfer of immovable property in India by non-residents and vice versa

- It addresses the restrictions, procedural requirements, and conditions for repatriation of sale proceeds, ensuring a clear understanding of cross-border asset management

- [Borrowings]

- This unit discusses the various aspects of borrowings, including trade finance, External Commercial Borrowings (ECB), acceptance of deposits, and issuance of guarantees

- It provides detailed guidelines on the procedures, compliance requirements, and benefits associated with different types of borrowings

- [International Financial Services Centre (IFSC)]

- This unit explains the strategic objectives, benefits, and regulatory framework of IFSCs

- It highlights the promotion of investments in IFSCs by the Central Government and discusses the provisions related to overseas investment in and out of IFSCs

- [Trade Transactions]

- This unit covers the regulations governing exports, imports, and merchanting trade

- It details the procedural requirements, obligations of exporters, realisation and repatriation of export proceeds, and the various types of exports, providing a comprehensive guide for trade-related transactions

- [Contravention and Offences]

- This unit addresses the consequences of non-compliance with FEMA, including the process of compounding, penalty provisions, adjudication procedures, and the role of the Enforcement Directorate

- It provides practical examples and case studies to illustrate the compounding process and the implications of non-compliance

- [Overseas Investment]

- This unit provides a detailed framework of the new overseas investment regime, including definitions, pre-conditions, routes, and pricing guidelines for making overseas investments

- It covers the roles and responsibilities of AD banks, reporting requirements, and the procedures for disinvestment and restructuring

Sudha G. Bhushan

Sudha Bhushan is a distinguished Company Secretary (2001), Chartered Accountant (2007), Insolvency Resolution Professional (2019), and Registered Valuer with IBBI (2019). She founded Manage My Expat, a platform that provides tax, regulatory, and compliance services to multinational entities.

With over two decades of experience in international transaction advisory, business structuring, regulatory affairs, and valuations, Sudha has been involved in numerous intricate structuring and investment transactions in India and internationally. She is a pioneer in due diligence under the Foreign Exchange Management Act (FEMA) in India. Industry professionals highly seek her for her expertise in inward and outward investments and valuation matters. She adeptly handles complicated Enforcement Directorate (ED) matters and has been appointed as an Insolvency Resolution Professional in various cases by the National Company Law Tribunal (NCLT).

Sudha serves as an Independent Director on the boards of several Indian companies, including Aurionpro Solutions Limited, Choice International Limited, West Coast Paper Mills Limited, JNK India Limited, DIGJAM Limited, and SASMOS HET Technologies Limited.

An avid writer, Sudha’s articles are regularly published in various journals. She has authored several bestselling books, including:

- Overseas Investment (Taxmann, 2023)

- Practical Guide to FEMA, 1999 (Taxmann, 2022)

- International Transactions – A Comprehensive Review (CCH)

- Due Diligence under Foreign Exchange Management Act, 1999 (CCH)

- Comprehensive Guide to Foreign Exchange Management (CCH, two volumes)

- Practical Guide to Foreign Exchange Management (CCH, a Wolter Kluwers company)

- Practical Aspects of Foreign Direct Investment in India (Institute of Company Secretaries of India)

- Handbook on Foreign Exchange Management Act, 2000 (Institute of Chartered Accountants of India)

- Handbook on International Taxation (Institute of Company Secretaries of India)

Sudha is actively involved in several professional committees, including:

- Co-chairperson of the Entrepreneurs Now Committee at Indian Merchant Chamber – LW

- Committee member of the NBFC Committee of the Indian Merchant Chamber

- Member of Indo-French Chamber of Commerce and Industry

- Member of the Committee of International Taxation of WIRC, Institute of Chartered Accountants of India (ICAI)

- Member of the Committee of Women Empowerment of ICAI

- Member of the Committee of Professional Development of ICSI

Her extensive career includes positions at international firms such as Deloitte, a German consulting firm, and the Indian investment banking arm of an Irish company.

Sudha, a lifelong scholar, has received numerous awards and recognitions, including the ‘Women Empowerment through CA Profession’ award from the Northern India Regional Council (NIRC) of the CA Institute. She is a noted speaker who has addressed over 500 national and international forums, including Horasis Asia Meet, Indian Merchant Chamber, FICCI, and various institutes such as ICAI and ICSI. She is also a visiting faculty member at prestigious business schools like Kohinoor Business School and NMIMS.

Beyond her professional life, Sudha is an avid reader who loves exploring technology and the stock market.

![Taxmann's - Bharatiya Nyaya Sanhita 2023 | Flexi-bound [Pocket] Edition](https://cashapers.in/wp-content/uploads/2024/08/Book1.1.jpg)

Reviews

There are no reviews yet.