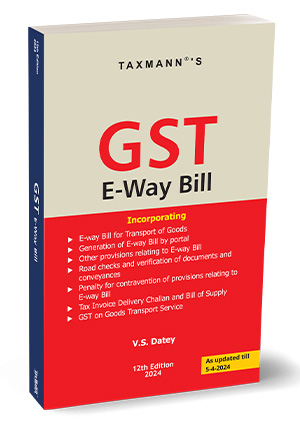

This book comprehensively analyses the GST E-Way Bill system, enriched with case laws and practical examples. It covers everything from the generation of E-Way Bills to road checks and tax invoices, making it a must-have resource for tax professionals who want to understand the complexities of GST in goods transportation.

Description

This book presents a comprehensive and updated analysis of all aspects of the GST E-Way Bill, presented in an easy-to-understand format, enriched with relevant Case Laws. The book also includes practical examples and FAQs to aid in better understanding and application of the rules.

This book is designed for tax professionals, business owners, and students; this edition serves as a helpful resource for understanding the intricacies of GST in goods transportation.

The Present Publication is the 12th Edition | 2024 and has been updated till 05th April 2024. This book is authored by V.S. Datey & incorporates the following:

- E-Way Bill for Transport of Goods

- Filling of Part B of the E-Way Bill

- Generation of E-Way Bill by the Portal

- Other Provisions Relating to E-Way Bill

- Road Check and Verification of Documents and Conveyances

- Case Laws in Respect of Detention, Seizure, and Release of Goods and Conveyance in Transit

- Tax Invoice

- Delivery Challan

- Bill of Supply when no Tax Invoice is Required

- GST on Goods Transport Service

V.S. Datey

Mr V.S. Datey, based out of Pune (Maharashtra), has worked for close to 27 years in the corporate field at senior levels in leading listed companies like Kirloskar Tractors, Taparia Tools, as Company Secretary and General Manager (Finance), from 1966 to 1993.

He started his career as an author of books relating to indirect taxes in 1993. Presently, he is writing books on indirect taxes and corporate laws. Taxmann published all his books. His books have been prescribed for professional examinations like CA, CS and ICMA and are widely preferred by professionals and departmental officers. Mr Datey conducts various training programmes on indirect tax-related topics.

Reviews

There are no reviews yet.