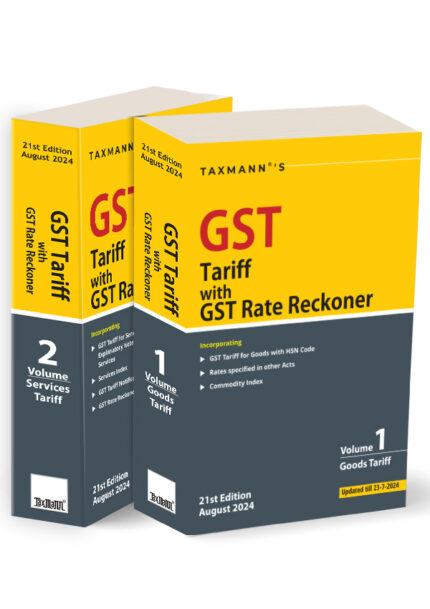

This two-volume set offers the most authoritative and exhaustive analysis of the Customs Tariff Act 1975, providing clear and precise information on tariffs, duties, and related regulations. It includes practical guidance for accurately calculating import and export duties. The key features include comprehensive annexures, detailed commodity coverage, and user-friendly navigation tools.

Description

This two-volume set offers the most authoritative and exhaustive analysis of the Customs Tariff Act 1975. Meticulously organized, it delivers clear and precise information on tariffs, duties, and related regulations—along with practical guidance for accurately calculating various import and export duties.

It is helpful for a diverse range of professionals, including customs officers, tax professionals, importers and exporters, legal practitioners, and trade compliance specialists.

The Present Publication is the 80th Edition | 2024-25 and is updated till 23rd July 2024. This book is edited/authored by R.K. Jain, with the following noteworthy features:

- [Authoritative Analysis] Provides the most comprehensive and authoritative analysis of the Customs Tariff Act

- [Exhaustive Coverage] Includes detailed examination of the Customs Tariff Act and all subsequent amendments, notifications, and associated regulations.

- [Practical Guidance] Provides step-by-step instructions for accurately calculating various import and export duties, including illustrative examples

- [User-Friendly Structure] Organized for easy navigation, with clear sections and detailed notes

- [Annexures] Contains comprehensive annexures on cesses, additional duties, and other levies, including Compensation Cess, Social Welfare Surcharge, etc.

- [Detailed Content] Covers a wide range of commodities and their respective tariffs, duties, and exemptions, with specific rules for interpretation and application

- [Updated Information] Incorporates the latest amendments and notifications to ensure readers have the most current information

- [Multi-Part Organization] Divided into two volumes with multiple parts, each addressing different aspects of customs tariffs and duties

- [Quick Reference Tools] Includes a commodity index and a chronological list of basic notifications for easy reference

The structure of the book is as follows:

- Volume 1

- How to Use This Tariff?

- A practical guide for navigating the tariff schedule

- Instructions for calculating the effective rate of import duty, with illustrative examples

- Part 1 – Customs Tariff Act, 1975

- The complete text of the Customs Tariff Act, 1975

- Key sections on the levy of duties, additional duties, protective duties, and emergency powers

- Details on amendments to the First Schedule and other significant provisions

- Part 2 – Import Tariff

- First Schedule of the Customs Tariff Act, organized into 98 chapters and 21 sections

- Includes:

- Rules for Interpretation

- Section and Chapter Notes

- Tariff values, anti-dumping duties, countervailing duties

- Safeguard duties and exemption notifications

- Departmental clarifications

- How to Use This Tariff?

- Volume 2

- Part 3 – Export Tariff

- Second Schedule listing commodities subject to export duty.

- Includes exemption notifications and detailed tariff rates.

- Part 4 – Integrated Goods & Services Tax (IGST)

- Extracts from the IGST Act.

- IGST rules, rates, and exemptions.

- Relevant notifications for IGST procedures and exemptions.

- Part 5 – Cesses, Additional Duties & Other Levies

- Annexures covering:

- Compensation Cess

- Additional Duty of Customs

- Special Duty

- Social Welfare Surcharge

- Road & Infrastructure Cess

- Health Cess

- Agriculture Infrastructure and Development Cess

- Baggage Rules

- Project Imports Regulations

- Annexures covering:

- Part 6 – Safeguard Duty

- Rules and notifications on safeguard duties

- Bilateral safeguard measures under various trade agreements

- Part 7 – Anti-dumping Duty & Countervailing Duty

- Rules for identifying, assessing, and collecting anti-dumping and countervailing duties

- Relevant notifications and refund rules for excess anti-dumping duties

- Part 8 – Miscellaneous

- Commodity index for quick reference

- Chronological list of basic notifications for easy navigation

- Part 3 – Export Tariff

R.K. Jain

Sh. R.K. Jain is a distinguished author specializing in Indirect Taxes, including Customs, Central Excise, Service Tax, Foreign Trade Policy (FTP), GST, and FEMA. He began his illustrious career in the early seventies. In 1975, he published the seminal works ‘Customs & Excise Tariffs and Manuals,’ which have recently celebrated their Silver and Golden Jubilee Editions.

Sh. R.K. Jain is also the editor of ‘Excise Law Times (E.L.T.),’ launched nearly 45 years ago. This journal brought significant awareness to Central Excise and Customs and has grown to become the leading publication in its field with the largest circulation.

In addition to E.L.T., he started ‘Service Tax Review’ in 2006 and ‘R.K. Jain’s GST Law Times’ in 2017, following the major Indirect Tax Reform introduced by GST. ExCus, the digital version of these journals, continues to provide valuable insights and updates on Indirect Taxes.

![Taxmann's - Bharatiya Nyaya Sanhita 2023 | Flexi-bound [Pocket] Edition](https://cashapers.in/wp-content/uploads/2024/08/Book1.1.jpg)

Reviews

There are no reviews yet.