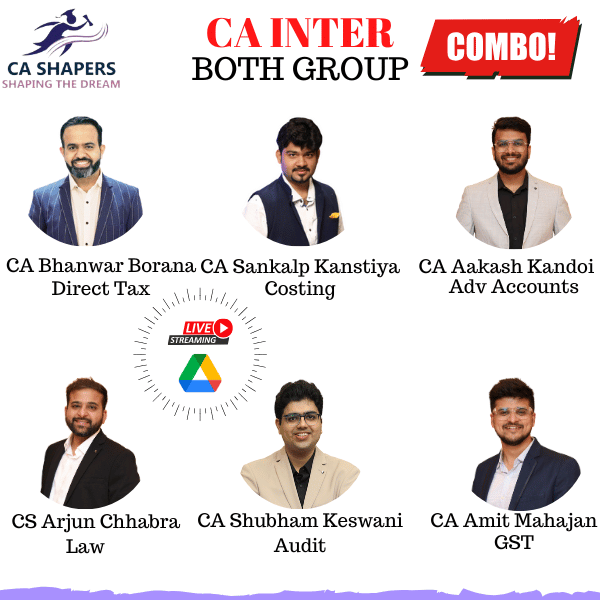

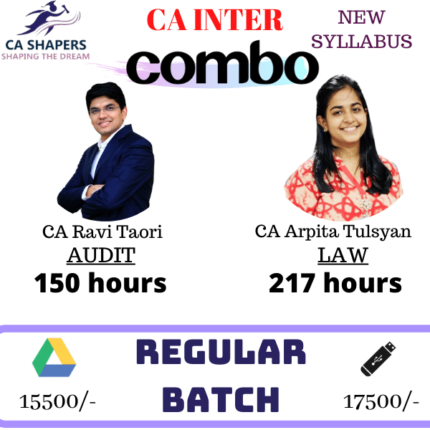

CA Inter – Both Group Combo Exam Oriented Batch – SPC

2 views & 6 months validity

Duration – Audit 75 hrs | Costing 130 hrs | FM SM 130 hrs | Audit 75 hrs | Costing 130 hrs | FM SM 130 hrs

SYSTEM REQUIREMENTS – Lectures will run on Android/Windows (laptop only) (STRICTLY PROHIBITED ON DESKTOP AND IOS) -Windows- 8,8.1,10 (Only 64 bit operating system is applicable -Ram- 4GB (Mandatory) -Processor- if (i3/i5/i7)-Sharable Memory Above 500MB -Others-Graphic card 1GB Min.(Mandatory) – Android version 5 onwards (Pendrive Orders will not work in Redmi Note 8 , 9 , 10) – Redmi 9 pro – Oppo A31 – Vivo y12 models) – Ram 2 GB MinimumCA Inter – Advanced Accounting Exam Oriented Batch – CA Anand Bhangariya

₹5,590.00

CA Inter – Corporate & Other Laws Exam Oriented Batch – CA Ankita Patni

₹4,100.00

CA Inter – FM SM New Syllabus Exam Oriented Batch – CA Swapnil Patni

₹6,000.00

Reviews

There are no reviews yet.